Economy, Calculations, Data

Potus, Incumbent Elec. College Percentage Prediction

Time for Change model, (my post)

GDP is taken as annualized quarterly growth rate, quarter growth compared to previous quarter, annualized.

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1945, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

df = data.DataReader(['GDPC1'], 'fred', start, end)

df['growann'] = ( ( (1+df.pct_change())**4 )-1.0 )*100.0

#print (df[pd.DatetimeIndex(df.index).year == 1984]['growann'])

print (df['growann'].tail(5))

# look at Q2, 04-01 date

DATE

2019-10-01 2.365628

2020-01-01 -4.955763

2020-04-01 -31.383181

2020-07-01 33.441306

2020-10-01 4.091780

Name: growann, dtype: float64

from io import StringIO

import statsmodels.formula.api as smf

import pandas as pd

s="""year,gdp_growth,net_approval,two_terms,incumbent_vote

2012,1.3,-0.8,0,52

2008,1.3,-37,1,46.3

2004,2.6,-0.5,0,51.2

2000,8,19.5,1,50.3

1996,7.1,15.5,0,54.7

1992,4.3,-18,1,46.5

1988,5.2,10,1,53.9

1984,7.1,20,0,59.2

1980,-7.9,-21.7,0,44.7

1976,3,5,1,48.9

1972,9.8,26,0,61.8

1968,7,-5,1,49.6

1964,4.7,60.3,0,61.3

1960,-1.9,37,1,49.9

1956,3.2,53.5,0,57.8

1952,0.4,-27,1,44.5

1948,7.5,-6,1,52.4

"""

df = pd.read_csv(StringIO(s))

regr = 'incumbent_vote ~ gdp_growth + net_approval + two_terms'

results = smf.ols(regr, data=df).fit()

print ('R^2', results.rsquared)

conf = results.conf_int()

net_approv = -10.0; gdp_growth = 0.0

pred = [1., gdp_growth, net_approv, 0]

print (np.dot(pred, conf), np.dot(pred, results.params))

R^2 0.9011858911763367

[49.14454875 51.75431018] 50.4494294659622

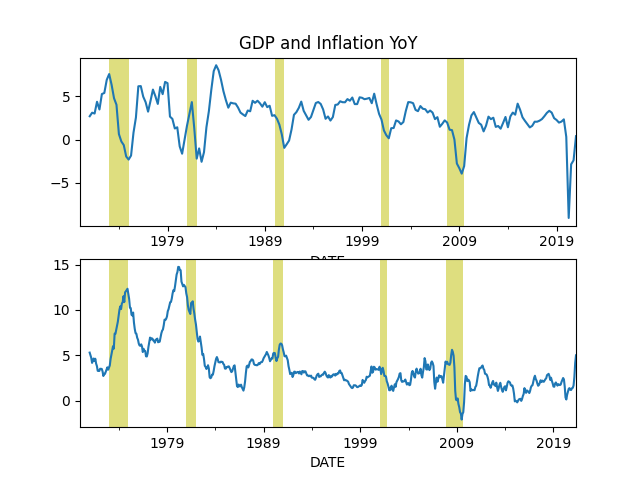

The Cycle

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1970, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

fig, axs = plt.subplots(2)

df = data.DataReader(['GDPC1'], 'fred', start, end)

df['gdpyoy'] = (df.GDPC1 - df.GDPC1.shift(4)) / df.GDPC1.shift(4) * 100.0

df['gdpyoy'].plot(ax=axs[0],title="GDP and Inflation YoY")

axs[0].axvspan('01-11-1973', '01-03-1975', color='y', alpha=0.5, lw=0)

axs[0].axvspan('01-07-1981', '01-11-1982', color='y', alpha=0.5, lw=0)

axs[0].axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

axs[0].axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

axs[0].axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df[['gdpyoy']].tail(6))

df = data.DataReader(['CPIAUCNS'], 'fred', start, end)

df['infyoy'] = (df.CPIAUCNS - df.CPIAUCNS.shift(12)) / df.CPIAUCNS.shift(12) * 100.0

df['infyoy'].plot(ax=axs[1])

axs[1].axvspan('01-11-1973', '01-03-1975', color='y', alpha=0.5, lw=0)

axs[1].axvspan('01-07-1981', '01-11-1982', color='y', alpha=0.5, lw=0)

axs[1].axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

axs[1].axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

axs[1].axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df[['infyoy']].tail(6))

plt.savefig('cycle.png')

gdpyoy

DATE

2019-10-01 2.338885

2020-01-01 0.319261

2020-04-01 -9.032775

2020-07-01 -2.848345

2020-10-01 -2.386694

2021-01-01 0.397284

infyoy

DATE

2020-12-01 1.362005

2021-01-01 1.399770

2021-02-01 1.676215

2021-03-01 2.619763

2021-04-01 4.159695

2021-05-01 4.992707

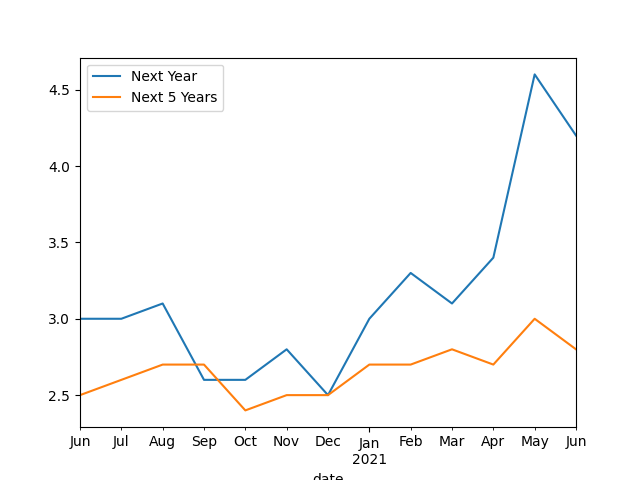

Inflation Expection

Data comes from the University of Michigan survey.

import pandas as pd

pd.set_option('display.max_columns', None)

df = pd.read_csv('http://www.sca.isr.umich.edu/files/tbcpx1px5.csv',skiprows=4,header=None)

df1 = df[[0,1,3,5]]

df1 = df1.dropna()

df1.columns = ['Mon','Year','Next Year','Next 5 Years']

df1['sdate'] = df1.apply(lambda x: x.Mon + "-" + str(int(x['Year'])),axis=1)

df1['date'] = pd.to_datetime(df1.sdate)

df1 = df1.set_index('date')

df1[['Next Year','Next 5 Years']].plot()

plt.savefig('infexp.png')

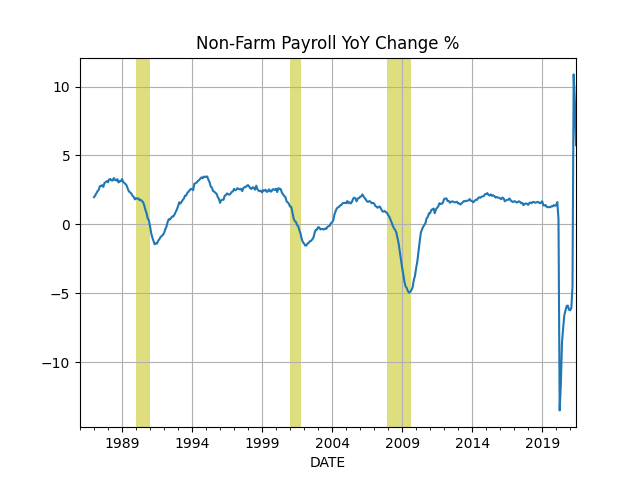

Wages and Unemployment

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1986, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['PAYEMS']

df = data.DataReader(cols, 'fred', start, end)

df['nfpyoy'] = (df.PAYEMS - df.PAYEMS.shift(12)) / df.PAYEMS.shift(12) * 100.0

print (df.tail(7))

df.nfpyoy.plot()

plt.grid(True)

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.title('Non-Farm Payroll YoY Change %')

plt.savefig('nfp.png')

PAYEMS nfpyoy

DATE

2020-12-01 142503 -6.198040

2021-01-01 142736 -6.239079

2021-02-01 143272 -6.065315

2021-03-01 144057 -4.496818

2021-04-01 144326 10.882676

2021-05-01 144909 8.959051

2021-06-01 145759 5.745067

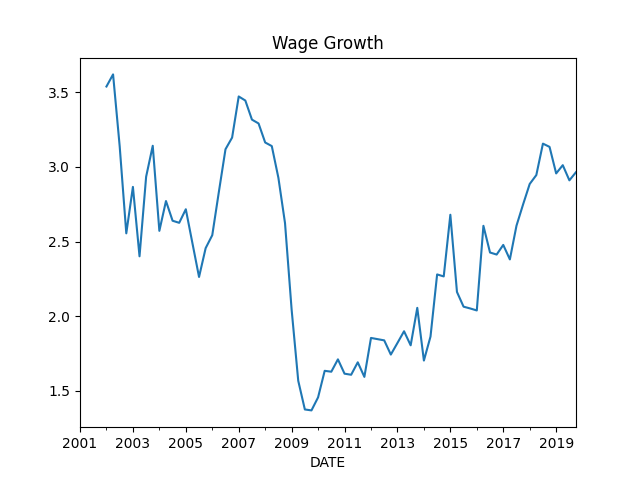

import pandas as pd, datetime

from pandas_datareader import data

start=datetime.datetime(1950, 1, 1)

end=datetime.datetime(2019, 11, 1)

cols = ['ECIWAG']

df3 = data.DataReader(cols, 'fred', start, end)

df3 = df3.dropna()

df3['ECIWAG2'] = df3.shift(4).ECIWAG

df3['wagegrowth'] = (df3.ECIWAG-df3.ECIWAG2) / df3.ECIWAG2 * 100.

print (df3['wagegrowth'].tail(4))

df3['wagegrowth'].plot(title='Wage Growth')

plt.savefig('wages.png')

DATE

2019-01-01 2.956785

2019-04-01 3.012048

2019-07-01 2.910448

2019-10-01 2.965159

Name: wagegrowth, dtype: float64

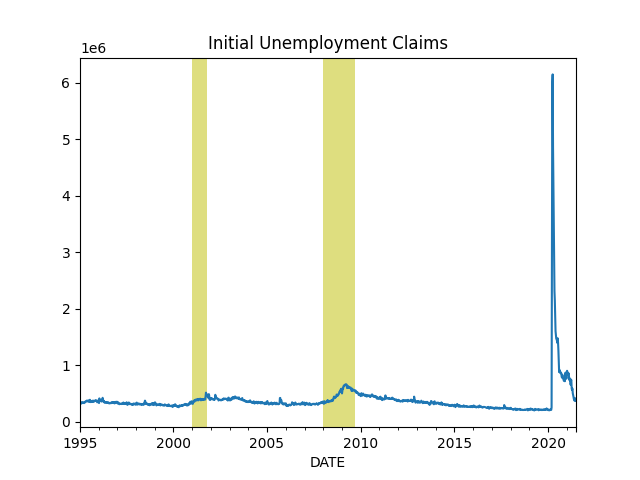

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1995, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['ICSA']

df = data.DataReader(cols, 'fred', start, end)

df.ICSA.plot()

print (df.tail(4))

plt.title("Initial Unemployment Claims")

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('icsa.png')

ICSA

DATE

2021-06-12 418000

2021-06-19 416000

2021-06-26 371000

2021-07-03 373000

Calculation is based on [2]

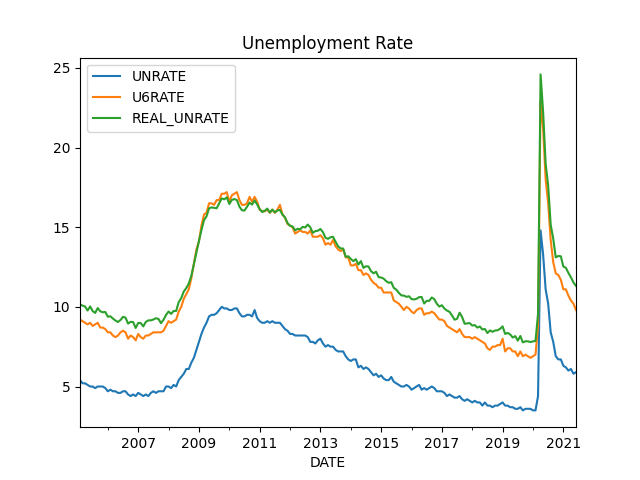

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1986, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['LNS12032194','UNEMPLOY','NILFWJN','LNS12600000','CLF16OV','UNRATE','U6RATE']

df = data.DataReader(cols, 'fred', start, end)

df['REAL_UNEMP_LEVEL'] = df.LNS12032194*0.5 + df.UNEMPLOY + df.NILFWJN

df['REAL_UNRATE'] = (df.REAL_UNEMP_LEVEL / df.CLF16OV) * 100.0

pd.set_option('display.max_columns', None)

df1 = df.loc[df.index > '2005-01-01']

df1[['UNRATE','U6RATE','REAL_UNRATE']].plot()

plt.title('Unemployment Rate')

print (df1[['UNRATE','U6RATE','REAL_UNRATE','REAL_UNEMP_LEVEL']].tail(5))

plt.savefig('unemploy.png')

UNRATE U6RATE REAL_UNRATE REAL_UNEMP_LEVEL

DATE

2021-02-01 6.2 11.1 12.451704 19949.0

2021-03-01 6.0 10.7 12.128327 19473.0

2021-04-01 6.1 10.4 11.852126 19080.5

2021-05-01 5.8 10.2 11.527325 18551.5

2021-06-01 5.9 9.8 11.314143 18225.5

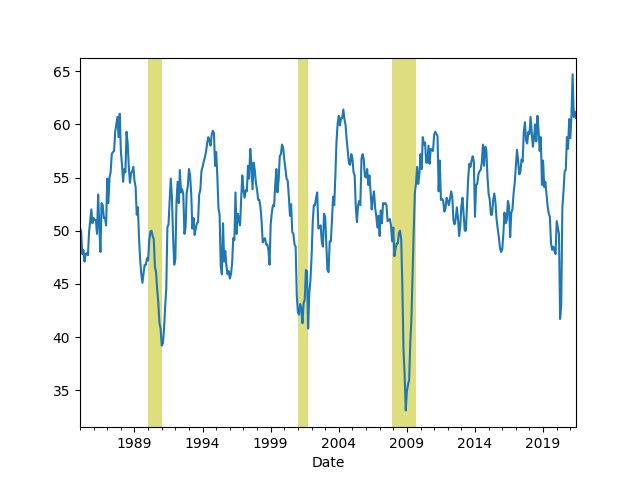

PMI

import quandl, os, datetime

from datetime import timedelta

today = datetime.datetime.now()

start=datetime.datetime(1985, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

today = datetime.datetime.now()

df = quandl.get("ISM/MAN_PMI-PMI-Composite-Index",

returns="pandas",

start_date=start.strftime('%Y-%m-%d'),

end_date=today.strftime('%Y-%m-%d'),

authtoken=open(".quandl").read())

print (df['PMI'].tail(4))

df['PMI'].plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('pmi.png')

Date

2021-03-01 64.7

2021-04-01 60.7

2021-05-01 61.2

2021-06-01 60.6

Name: PMI, dtype: float64

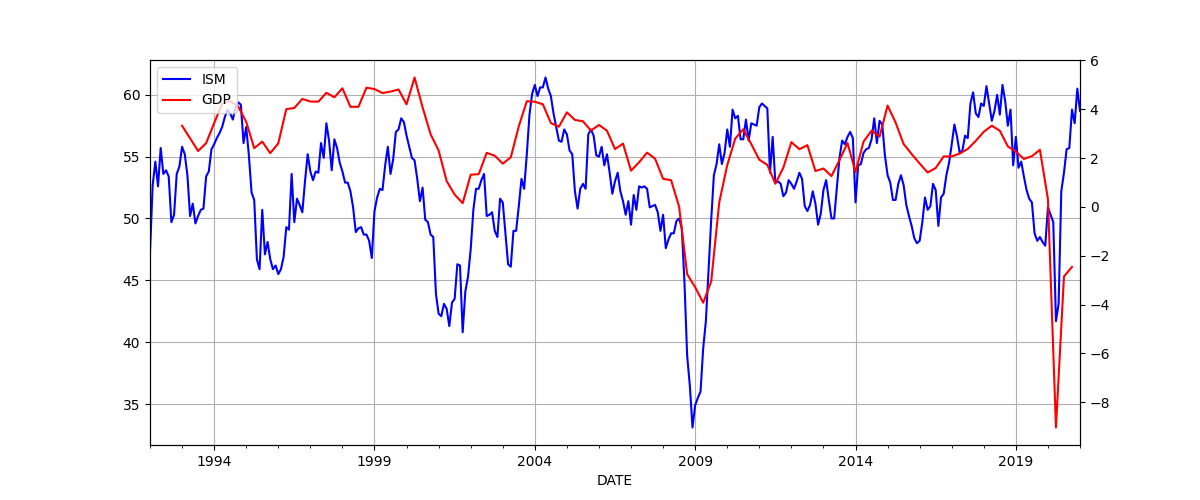

GDP vs ISM

import pandas as pd, datetime

from pandas_datareader import data

import quandl

today = datetime.datetime.now()

start=datetime.datetime(1992, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['GDPC1']

df = data.DataReader(cols, 'fred', start, end)

df['gdpyoy'] = (df.GDPC1 - df.GDPC1.shift(4)) / df.GDPC1.shift(4) * 100.0

df2 = quandl.get("ISM/MAN_PMI-PMI-Composite-Index",

returns="pandas",

start_date=start.strftime('%Y-%m-%d'),

end_date=end.strftime('%Y-%m-%d'),

authtoken=open(".quandl").read())

plt.figure(figsize=(12,5))

ax1 = df2.PMI.plot(color='blue', grid=True, label='ISM')

ax2 = df.gdpyoy.plot(color='red', grid=True, label='GDP',secondary_y=True)

h1, l1 = ax1.get_legend_handles_labels()

h2, l2 = ax2.get_legend_handles_labels()

plt.legend(h1+h2, l1+l2, loc=2)

plt.savefig('gdp-ism.png')

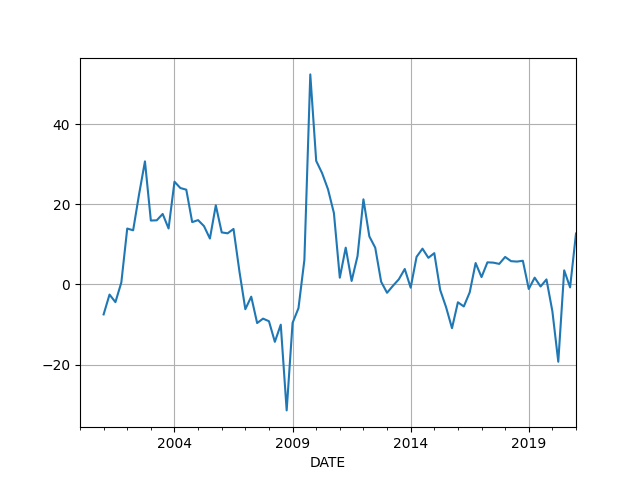

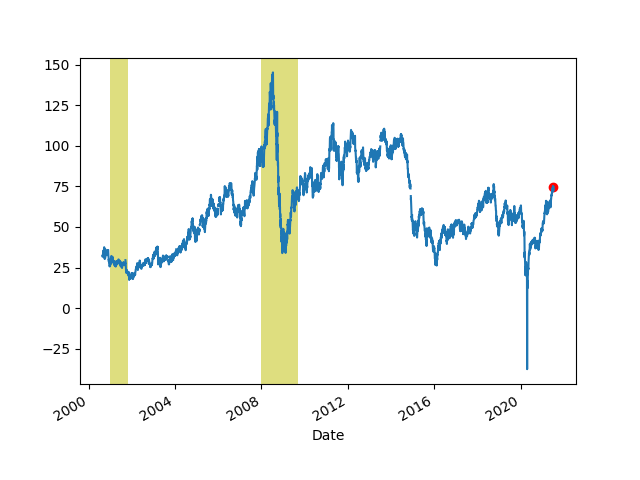

Profits YoY

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(2000, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['CPROFIT']

df = data.DataReader(cols, 'fred', start, end)

df['cpyoy'] = (df.CPROFIT - df.CPROFIT.shift(4)) / df.CPROFIT.shift(4) * 100.0

print (df.tail(4))

df.cpyoy.plot()

plt.grid(True)

plt.savefig('profit.png')

CPROFIT cpyoy

DATE

2020-04-01 1826.137 -19.309944

2020-07-01 2325.730 3.528294

2020-10-01 2294.300 -0.734314

2021-01-01 2294.052 12.728166

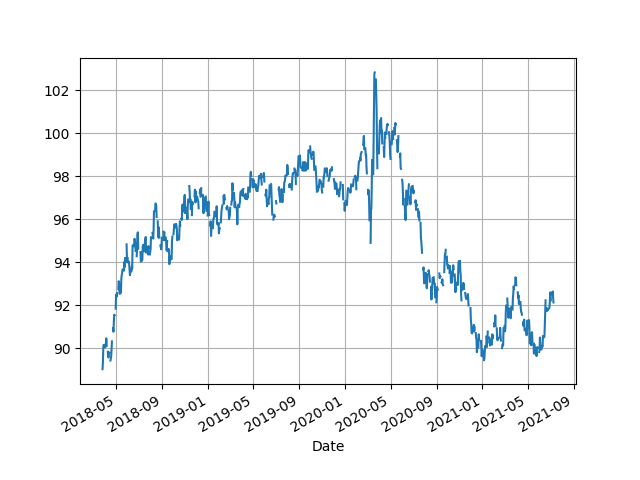

Dollar

import pandas as pd, datetime, time as timelib

import urllib.request as urllib2, io

end = datetime.datetime.now()

start = datetime.datetime(1980, 1, 1)

start = int(timelib.mktime(start.timetuple()))

end = int(timelib.mktime(end.timetuple()))

base_fin_url = "https://query1.finance.yahoo.com/v7/finance/download"

url = base_fin_url + "/DX-Y.NYB?period1=" + str(start) + "&period2=" + str(end) + "&interval=1d&events=history&includeAdjustedClose=true"

r = urllib2.urlopen(url).read()

file = io.BytesIO(r)

df = pd.read_csv(file,index_col='Date',parse_dates=True)['Adj Close']

print (df.tail(4))

m,s = df.mean(),df.std()

print (np.array([m-s,m+s]).T)

df.tail(1000).plot()

plt.grid(True)

plt.savefig('dollar.png')

Date

2021-07-06 92.550003

2021-07-07 92.639999

2021-07-08 92.360001

2021-07-09 92.129997

Name: Adj Close, dtype: float64

[ 80.67397112 111.34537021]

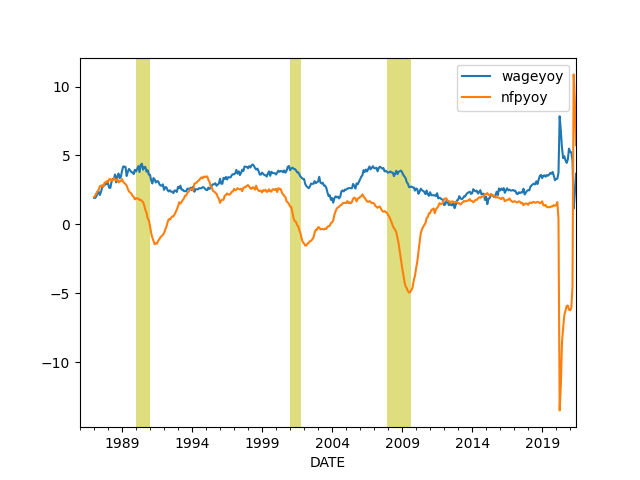

Difference Between Wage Growth YoY and Payrolls (Hiring)

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1986, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['PAYEMS','AHETPI']

df = data.DataReader(cols, 'fred', start, end)

df['nfpyoy'] = (df.PAYEMS - df.PAYEMS.shift(12)) / df.PAYEMS.shift(12) * 100.0

df['wageyoy'] = (df.AHETPI - df.AHETPI.shift(12)) / df.AHETPI.shift(12) * 100.0

df[['wageyoy','nfpyoy']].plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df['wageyoy'].tail(5))

print (df['nfpyoy'].tail(5))

plt.savefig('pay-wage.png')

DATE

2021-02-01 5.217028

2021-03-01 4.637681

2021-04-01 1.152623

2021-05-01 2.279088

2021-06-01 3.673799

Name: wageyoy, dtype: float64

DATE

2021-02-01 -6.065315

2021-03-01 -4.496818

2021-04-01 10.882676

2021-05-01 8.959051

2021-06-01 5.745067

Name: nfpyoy, dtype: float64

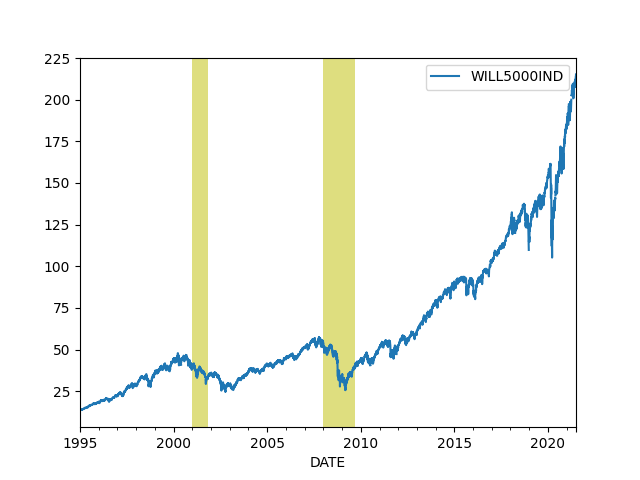

Total Market Cap / GDP

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1995, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['WILL5000IND']

df = data.DataReader(cols, 'fred', start, end)

df.plot()

print (df.tail(4))

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('wilshire.png')

WILL5000IND

DATE

2021-06-28 213.97

2021-06-29 213.94

2021-06-30 214.11

2021-07-01 215.21

Junk Bond Yields

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1980, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['BAMLH0A2HYBEY']

df = data.DataReader(cols, 'fred', start, end)

print (df.tail(6))

df.plot()

plt.plot(df.tail(1).index, df.tail(1),'ro')

plt.axvspan('2001-03-03', '2001-10-27', color='y', alpha=0.5, lw=0)

plt.axvspan('2007-12-22', '2009-05-09', color='y', alpha=0.5, lw=0)

plt.savefig('junkbond.png')

BAMLH0A2HYBEY

DATE

2021-05-10 4.49

2021-05-11 4.64

2021-05-12 4.69

2021-05-13 4.70

2021-05-14 4.64

2021-05-17 4.66

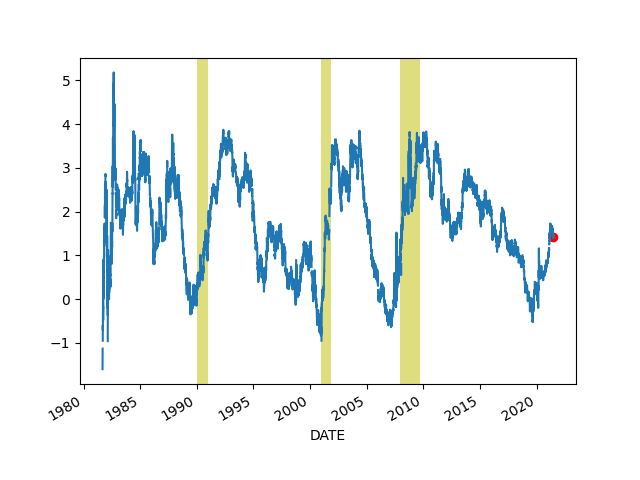

Yield Curve, Rates

10 Year Treasury Yield - 3 Month Bills

import pandas as pd, datetime

from pandas_datareader import data

pd.set_option('display.max_columns', 10)

today = datetime.datetime.now()

start=datetime.datetime(1980, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['DGS10','DGS3MO']

df = data.DataReader(cols, 'fred', start, end)

df['Yield Curve'] = df.DGS10 - df.DGS3MO

print (df.tail(6))

plt.plot(df.tail(1).index, df.tail(1)['Yield Curve'],'ro')

df['Yield Curve'].plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('yield-curve.png')

DGS10 DGS3MO Yield Curve

DATE

2021-06-24 1.49 0.05 1.44

2021-06-25 1.54 0.06 1.48

2021-06-28 1.49 0.05 1.44

2021-06-29 1.49 0.04 1.45

2021-06-30 1.45 0.05 1.40

2021-07-01 1.48 0.05 1.43

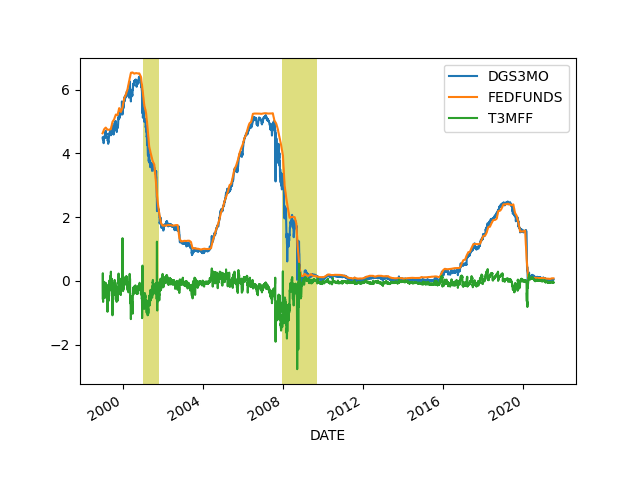

3-Month Treasury Constant Maturity Minus Federal Funds Rate

import pandas as pd, datetime

from pandas_datareader import data

pd.set_option('display.max_columns', 10)

today = datetime.datetime.now()

start=datetime.datetime(1999, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['DGS3MO','FEDFUNDS','T3MFF']

df = data.DataReader(cols, 'fred', start, end)

df = df.interpolate()

print (df.tail(6))

df.plot()

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('t3mff.png')

DGS3MO FEDFUNDS T3MFF

DATE

2021-06-24 0.05 0.08 -0.05

2021-06-25 0.06 0.08 -0.04

2021-06-28 0.05 0.08 -0.05

2021-06-29 0.04 0.08 -0.06

2021-06-30 0.05 0.08 -0.03

2021-07-01 0.05 0.08 -0.05

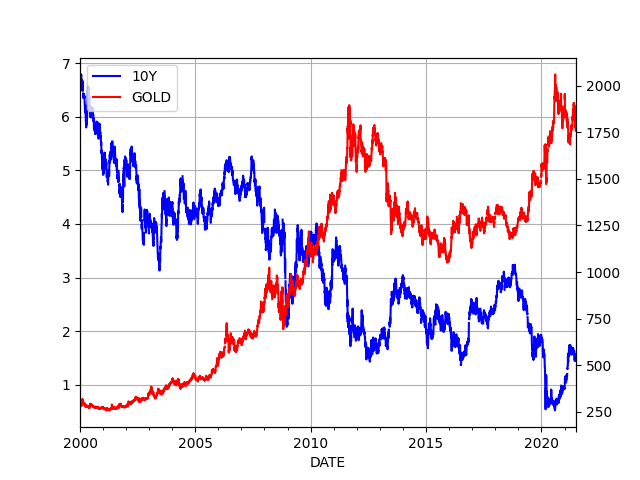

Gold and 10 Year Treasuries

from pandas_datareader import data

import datetime

today = datetime.datetime.now()

start=datetime.datetime(2000, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

df = data.DataReader(['DGS10', 'GOLDAMGBD228NLBM'], 'fred', start, end)

print (df.tail(5))

ax1 = df.DGS10.plot(color='blue', grid=True, label='10Y')

ax2 = df.GOLDAMGBD228NLBM.plot(color='red', grid=True, label='GOLD',secondary_y=True)

h1, l1 = ax1.get_legend_handles_labels()

h2, l2 = ax2.get_legend_handles_labels()

plt.legend(h1+h2, l1+l2, loc=2)

plt.savefig('10yrgld.png')

DGS10 GOLDAMGBD228NLBM

DATE

2021-06-28 1.49 1774.25

2021-06-29 1.49 1769.60

2021-06-30 1.45 1757.80

2021-07-01 1.48 1774.00

2021-07-02 NaN 1783.50

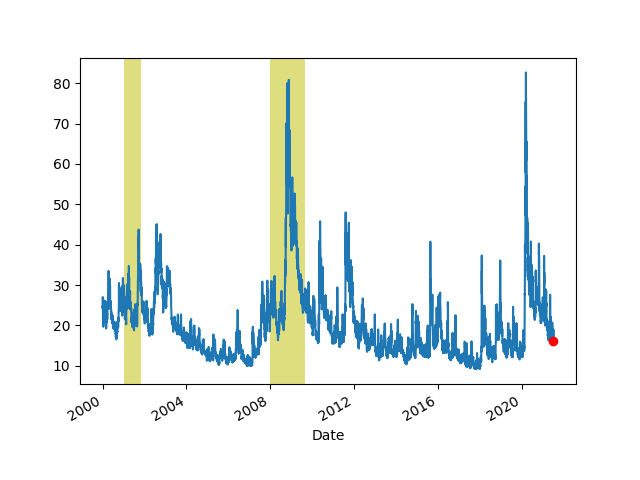

VIX

import pandas as pd, datetime, time as timelib

import urllib.request as urllib2, io

end = datetime.datetime.now()

start=datetime.datetime(2000, 1, 1)

start = int(timelib.mktime(start.timetuple()))

end = int(timelib.mktime(end.timetuple()))

base_fin_url = "https://query1.finance.yahoo.com/v7/finance/download"

url = base_fin_url + "/^VIX?period1=" + str(start) + "&period2=" + str(end) + "&interval=1d&events=history&includeAdjustedClose=true"

r = urllib2.urlopen(url).read()

file = io.BytesIO(r)

df = pd.read_csv(file,index_col='Date',parse_dates=True)['Adj Close']

df.plot()

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

print (df.tail(7))

plt.plot(df.tail(1).index, df.tail(1),'ro')

plt.savefig('vix.png')

Date

2021-06-30 15.830000

2021-07-01 15.480000

2021-07-02 15.070000

2021-07-06 16.440001

2021-07-07 16.200001

2021-07-08 19.000000

2021-07-09 16.180000

Name: Adj Close, dtype: float64

Oil

Futures, Continuous Contract, Front Month

import pandas as pd, datetime, time as timelib

import urllib.request as urllib2, io

end = datetime.datetime.now()

start = datetime.datetime(1980, 1, 1)

start = int(timelib.mktime(start.timetuple()))

end = int(timelib.mktime(end.timetuple()))

base_fin_url = "https://query1.finance.yahoo.com/v7/finance/download"

url = base_fin_url + "/CL=F?period1=" + str(start) + "&period2=" + str(end) + "&interval=1d&events=history&includeAdjustedClose=true"

r = urllib2.urlopen(url).read()

file = io.BytesIO(r)

df = pd.read_csv(file,index_col='Date',parse_dates=True)['Close']

print (df.tail(5))

plt.plot(df.tail(1).index, df.tail(1),'ro')

df.plot()

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('oil.png')

Date

2021-07-02 75.160004

2021-07-06 73.370003

2021-07-07 72.199997

2021-07-08 72.940002

2021-07-09 74.559998

Name: Close, dtype: float64

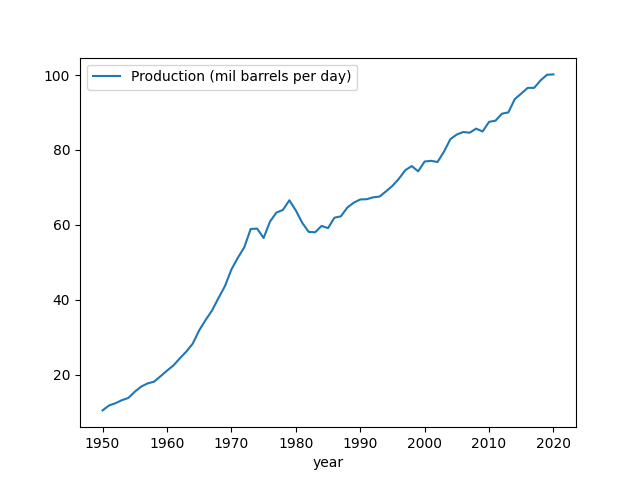

Oil Production

import pandas as pd

df = pd.read_csv('world-crude.csv',sep='\s', comment='#',index_col=0)

df.columns = ['Production (mil barrels per day)']

df.plot()

plt.savefig('crude-production.png')

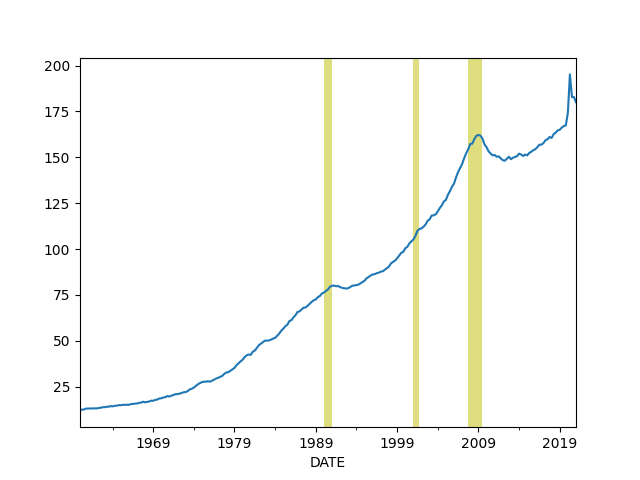

Private Debt to GDP Ratio

import pandas as pd, datetime

from pandas_datareader import data

today = datetime.datetime.now()

start=datetime.datetime(1960, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

df = data.DataReader(['GDPC1','QUSPAMUSDA'], 'fred', start, end)

df = df.interpolate()

df['Credit to GDP'] = (df.QUSPAMUSDA / df.GDPC1)*100.0

df['Credit to GDP'].plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('creditgdp.png')

print (df['Credit to GDP'].tail(4))

DATE

2020-04-01 195.193495

2020-07-01 182.902748

2020-10-01 182.816315

2021-01-01 180.019920

Freq: QS-OCT, Name: Credit to GDP, dtype: float64

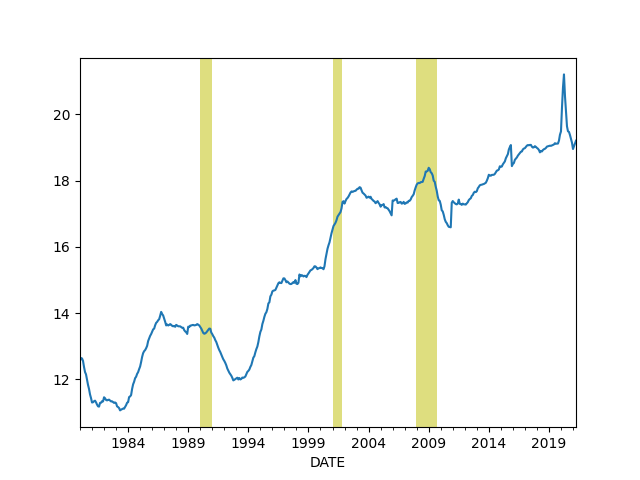

Total Consumer Credit Outstanding as % of GDP

import pandas as pd, datetime

from pandas_datareader import data

pd.set_option('display.max_columns', 10)

today = datetime.datetime.now()

start=datetime.datetime(1980, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['TOTALSL','GDP']

df = data.DataReader(cols, 'fred', start, end)

df = df.interpolate(method='linear')

df['debt'] = df.TOTALSL / df.GDP * 100.0

print (df.debt.tail(4))

df.debt.plot()

plt.axvspan('01-09-1990', '01-07-1991', color='y', alpha=0.5, lw=0)

plt.axvspan('01-03-2001', '27-10-2001', color='y', alpha=0.5, lw=0)

plt.axvspan('22-12-2007', '09-05-2009', color='y', alpha=0.5, lw=0)

plt.savefig('debt.png')

DATE

2021-01-01 18.956443

2021-02-01 19.039059

2021-03-01 19.123295

2021-04-01 19.207661

Freq: MS, Name: debt, dtype: float64

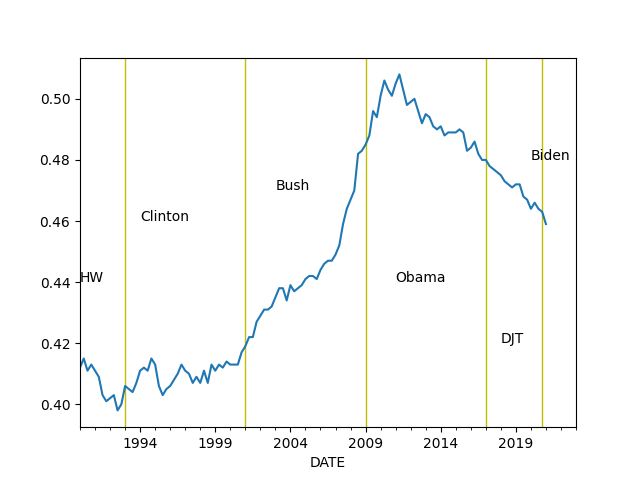

Wealth Inequality - GINI Index

Code taken from [3]

import pandas as pd, datetime

from pandas_datareader import data

def gini(pop,val):

pop = list(pop); pop.insert(0,0.0)

val = list(val); val.insert(0,0.0)

poparg = np.array(pop)

valarg = np.array(val)

z = valarg * poparg;

ord = np.argsort(val)

poparg = poparg[ord]

z = z[ord]

poparg = np.cumsum(poparg)

z = np.cumsum(z)

relpop = poparg/poparg[-1]

relz = z/z[-1]

g = 1 - np.sum((relz[0:-1]+relz[1:]) * np.diff(relpop))

return np.round(g,3)

today = datetime.datetime.now()

start=datetime.datetime(1989, 1, 1)

end=datetime.datetime(today.year, today.month, today.day)

cols = ['WFRBLT01026', 'WFRBLN09053','WFRBLN40080','WFRBLB50107']

df = data.DataReader(cols, 'fred', start, end)

p = [0.01, 0.09, 0.40, 0.50]

g = df.apply(lambda x: gini(p,x),axis=1)

print (g.tail(4))

g.plot()

plt.xlim('1990-01-01','2023-01-01')

plt.axvspan('1993-01-01','1993-01-01',color='y')

plt.axvspan('2001-01-01','2001-01-01',color='y')

plt.axvspan('2009-01-01','2009-01-01',color='y')

plt.axvspan('2017-01-01','2017-01-01',color='y')

plt.axvspan('2020-12-01','2020-12-01',color='y')

plt.text('1990-01-01',0.44,'HW')

plt.text('1994-01-01',0.46,'Clinton')

plt.text('2003-01-01',0.47,'Bush')

plt.text('2011-01-01',0.44,'Obama')

plt.text('2018-01-01',0.42,'DJT')

plt.text('2020-03-01',0.48,'Biden')

plt.savefig('gini.png')

DATE

2020-04-01 0.466

2020-07-01 0.464

2020-10-01 0.463

2021-01-01 0.459

dtype: float64

References, Notes

[1] Note: for Quandl retrieval get the API key from Quandl, and place the

key in a .quandl file in the same directory as this file.

[2] Komlos

[3] Mathworks